Workday’s $530M Acquisition of HiredScore, How Workday Is Expanding Its Market Reach and Capabilities

Exploring the Growth Drivers and Strategic Investments That Propelled Workday’s Q2 2024 Success: Q2 2024 SEC Filing — July 31, 2024

In the fast-evolving world of enterprise software, Workday, Inc. is not just keeping up with the pace — it’s setting new benchmarks for success. The company’s Q2 2024 financial results reveal more than just strong numbers; they showcase how strategic growth and innovation are driving Workday to the forefront of the industry. This quarter wasn’t just about meeting expectations — it was about redefining them. Let’s explore how Workday’s performance is shaping the future of enterprise software and what this means for the broader market.

Growth You Can’t Ignore

First, let’s talk numbers. Workday pulled in $2.085 billion in revenue this quarter. Now, that’s a big jump from $1.787 billion the same time last year. But here’s the thing — it’s not just about the revenue. It’s about how they did it. $1.903 billion of that came from subscription services. Think about it — subscription services are the backbone of any scalable business, and Workday’s done a fantastic job at keeping this engine running strong.

Why This Matters

Subscription services aren’t just a one-time deal. They’re a relationship. And Workday has figured out how to keep that relationship going — keeping customers engaged, satisfied, and coming back for more. That’s where real growth happens.

Profitability: A Balancing Act Done Right

Now, revenue is great, but what really impressed me was their operating income — $111 million, up from $36 million last year. That’s not just growth; that’s smart growth. You see, anyone can grow fast if they throw enough money at the problem. But Workday? They’re doing it while getting more profitable. Their net income jumped to $132 million from $79 million. That’s a 67% increase. Let me tell you, balancing growth with profitability isn’t easy, but Workday is pulling it off beautifully.

Earnings Per Share (EPS): Reflecting Value

And let’s not forget about the $0.49 in diluted earnings per share (EPS), up from $0.30 a year ago. That’s real value being delivered to shareholders. It shows that Workday’s growth is translating directly into shareholder wealth, which is exactly what you want to see.

Investing in the Future: This Is How You Stay Ahead

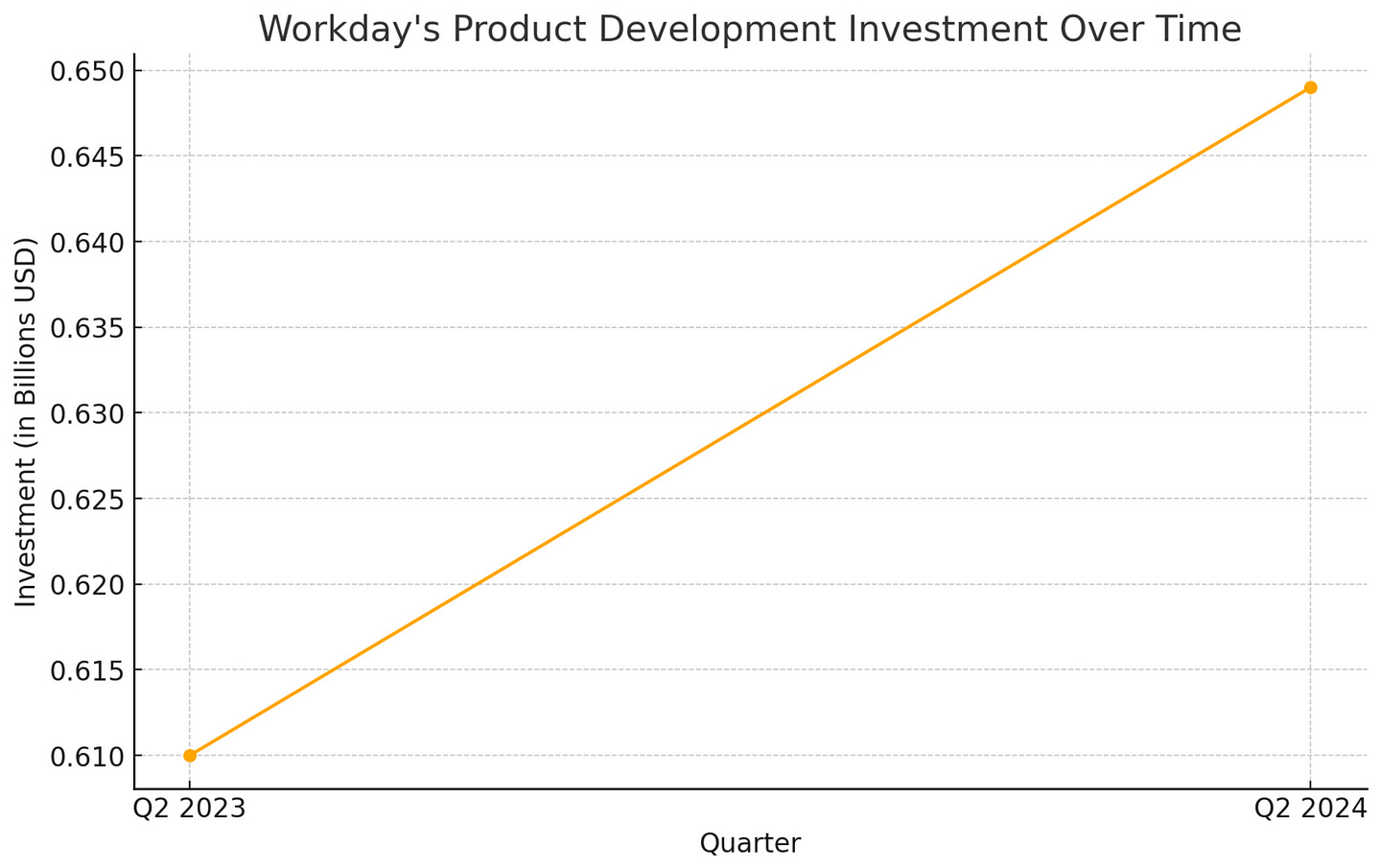

If you really want to understand why Workday is thriving, look at where they’re putting their money. $649 million went into product development. That’s up from $610 million last year. It might sound like just another expense, but it’s not — it’s an investment in the future. They’re pouring resources into AI, machine learning, and making their Human Capital Management (HCM) and Financial Management solutions the best in the business.

What’s the Big Deal?

This isn’t just about keeping up with the competition. It’s about leading the charge. Workday isn’t waiting for the market to tell them where to go — they’re defining it. And when you invest in innovation like that, you’re not just playing the game; you’re changing the rules.

Expanding Reach: Sales and Marketing Done Right

Another thing that caught my eye was their sales and marketing spend — $611 million, up from $524 million. Now, some people might look at that and think, “That’s a lot of money.” But let me tell you, this is money well spent. Workday is expanding its reach, and they’re doing it smartly. They’re not just throwing dollars at ads — they’re building relationships, expanding into new markets, and ensuring that they stay top of mind for businesses around the world.

Cash Flow: The Lifeblood of Business

A company’s cash flow tells you a lot about its health. Workday has $1.635 billion in cash and cash equivalents. That’s down from $2.012 billion earlier this year, but don’t let that worry you. They’re putting that money to work. Whether it’s through stock repurchases — 1.4 million shares bought back for $309 million — or investing in their future, they’re making sure their cash is driving growth, not just sitting idle.

Why This Matters

By buying back shares, Workday is saying, “We believe in our future.” They’re confident, and they’re backing it up with action. That’s the kind of move that shows strength and vision.

Deferred Revenue: The Engine for Future Growth

Deferred revenue is one of those things that might not grab headlines, but it’s incredibly important. Workday reported $3.549 billion in unearned revenue as of July 31, 2024, down from $4.057 billion in January. Now, you might wonder why that’s down, but here’s the deal — deferred revenue fluctuates with billing cycles. The key takeaway? This figure is a strong indicator that Workday has a solid pipeline of future revenue ready to be recognized as they deliver their services.

What’s the Big Picture?

Deferred revenue is like a promise of future growth. It shows that Workday is securing long-term contracts and has a steady stream of income ready to be realized. It’s like planting seeds today that will grow into tomorrow’s profits.

Strategic Acquisitions: Building More Than Just a Portfolio

You’ve got to love how Workday is thinking ahead. Their acquisition of HiredScore for $530 million is a perfect example. This isn’t just a purchase; it’s a strategic move that’s going to pay off big time. HiredScore brings AI-powered talent orchestration into the mix, enhancing Workday’s already robust suite of solutions.

What’s the Play Here?

This acquisition is about more than just adding another product. It’s about expanding what Workday can offer its customers — helping them manage talent more effectively in a world where the right people make all the difference.

Debt Management: Playing It Smart

Now, let’s talk about debt. Workday’s sitting on $3.0 billion in debt, which hasn’t changed from the last period. Some might see debt and get nervous, but here’s the truth — debt isn’t a bad thing if you manage it right. Workday’s debt is structured smartly, with long-term maturities that give them plenty of breathing room to invest and grow.

Operating Leases: Flexibility in Operations

Workday’s operating lease liabilities increased to $382 million from $316 million earlier this year. This might seem like a small detail, but it’s part of a bigger picture. Operating leases give Workday the flexibility to scale its operations without the heavy upfront costs of owning real estate or equipment outright.

Why This Matters

Flexibility is crucial in today’s fast-moving market. By using operating leases, Workday can adapt quickly to changes in the business environment, whether that means expanding to new locations or adjusting resources as needed.

Share-Based Compensation: Investing in Talent

In the technology industry, attracting and retaining top talent is crucial for driving innovation and maintaining a competitive edge. Workday’s share-based compensation expenses for Q2 2024 were $370 million, compared to $352 million in Q2 2023. This investment in human capital is a testament to Workday’s commitment to building a world-class team that can drive the company’s growth and success.

Aligning Employee Incentives with Company Goals

By offering share-based compensation, Workday aligns the interests of its employees with the company’s long-term goals. Employees who are invested in the company’s success are more likely to be motivated to contribute to its growth.

The Road Ahead: Building for Tomorrow

So, where does Workday go from here? They’re not slowing down, that’s for sure. With a strong focus on AI, global expansion, and making the most out of their recent acquisitions, they’re positioning themselves for even more growth. The way they’re investing in the future shows that they’re not just thinking about today — they’re building for tomorrow.

What Can We Learn?

Workday’s Q2 2024 performance is a masterclass in how to balance growth, profitability, and strategic investment. It’s not just about where they are now; it’s about where they’re going. And if you’re in the business of trying to lead — not just follow — there’s a lot to take away from what Workday is doing.

Disclaimer: This article is intended for informational purposes only and should not be construed as a stock recommendation. The analysis provided is based on publicly available data from SEC filings and reflects the author’s interpretation of the company’s financial performance and strategic decisions. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions.